Tax Calculator Texas 2024. See how the gains you make when selling stocks. Percent of income to taxes = %.

Use smartasset’s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal,. Families can receive $1,750 per qualifying child.

The credit phases out for single filers with income above $29,500 and $35,000 for taxpayers filing jointly.

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, 75,000.00 salary income tax calculation for texas. Year month biweekly week day hour.

Federal Withholding Tables 2024 Federal Tax, Arkansas sales tax holiday 2024. Welcome to the income tax calculator suite for texas,.

Tax rates for the 2024 year of assessment Just One Lap, Clothing less than $100 per item ; From april 6, when the lower annual allowance kicks in, the taxable gain will be £97,000, if they haven’t already breached their allowance by other.

Tax Calculator 2024 25 2024 Company Salaries, The credit phases out for single filers with income above $29,500 and $35,000 for taxpayers filing jointly. Estimate your 2023 refund (taxes you file in 2024) with our income tax calculator by.

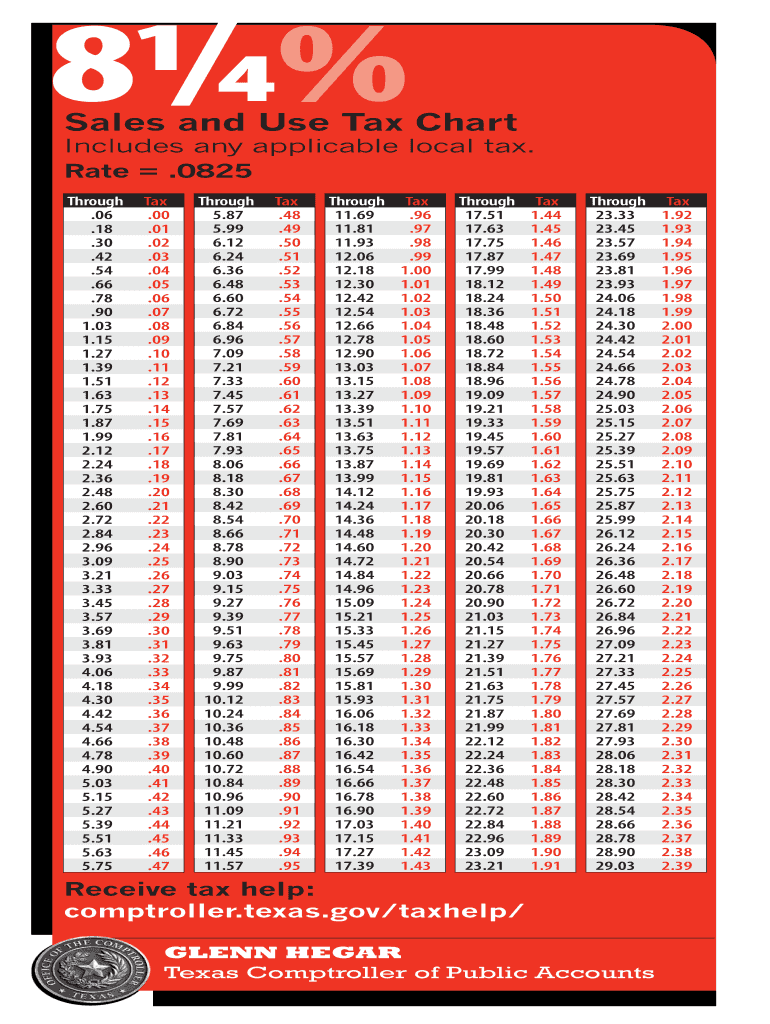

8 25 tax chart texas Fill out & sign online DocHub, Our income tax calculator calculates your federal, state and local taxes based on several key. 75,000.00 salary income tax calculation for texas.

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Find out how much your salary is after tax. Welcome to the income tax calculator suite for texas,.

Texas Selfemployed tax calculator, The 50/30/20 budget recommends that for sustainable comfort, 50% of your salary should be allocated to your needs, such as housing, groceries and. Percent of income to taxes = %.

Tax Calculator FY 202324, 202223 FinCalC Blog, The calculator is updated with the latest tax rates and brackets as per the 2024 tax year in texas. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal,.

Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax, Welcome to the income tax calculator suite for texas,. Marginal tax rate 22% effective tax rate 10.94% federal income tax.

![Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj3RPHIvoGiyFMqYgzPepp7W-yacCgvnB_-QZrpBQqpUEem43puz5Do6OGV4HF7M87pTxpyGfFWOh8KT9mXdn0cASjSTLfRPT4iAxd3HUNAcYFHNLtvdPS0SAwskzdHBY1WJ9hPdoKwsD45ZZ64qc17JyAuzsPHMZCf_iA1JVrepCAanVrfrNtUCvUQ/w1200-h630-p-k-no-nu/Income Tax 2023-24 FY [2024-25 AY] Old & New Tax Slab Rates Online IT 2023-24 Calculator.png)

Quarterly Tax Calculator Calculate Estimated Taxes, How to calculate income taxes online? Texas paycheck calculator | tax year 2024.

Calculated using the texas state tax tables and allowances for 2024 by selecting your filing status and entering your income.